Time Warner looks at ways to counter 21st Century Fox’s buyout bid

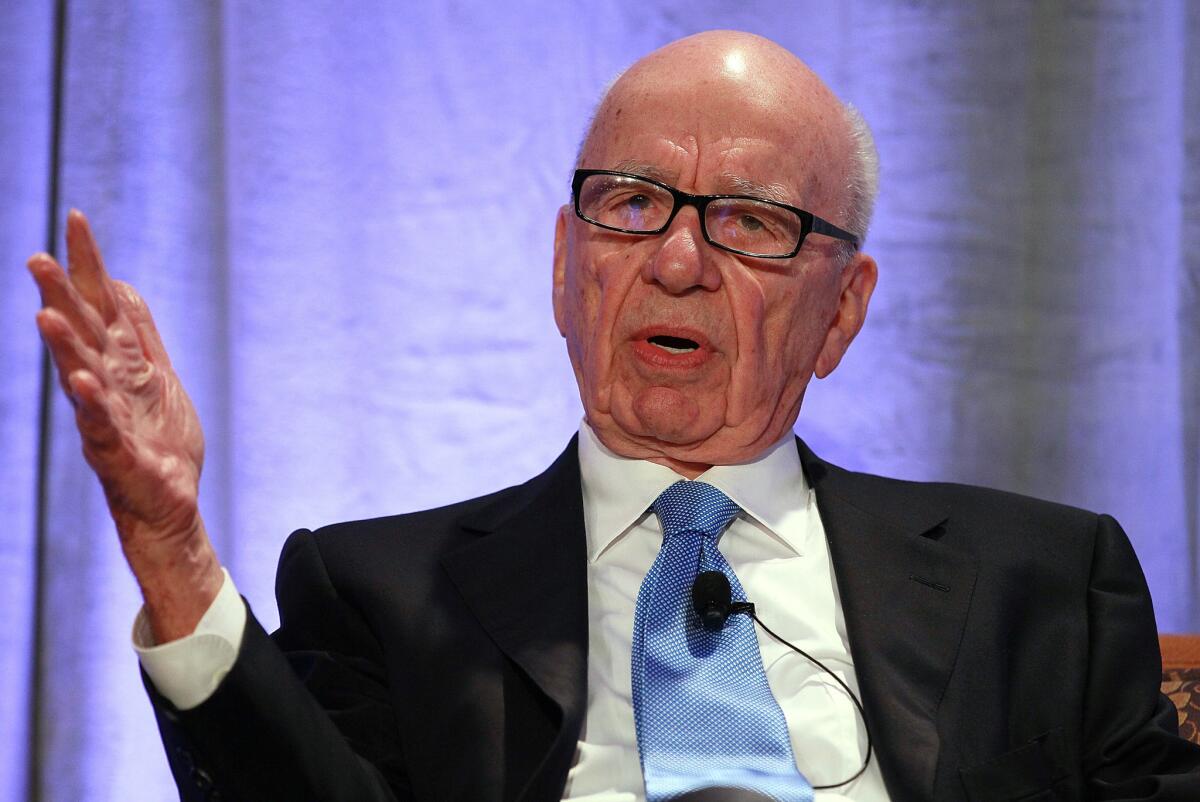

Rupert Murdoch’s entertainment company, 21st Century Fox, pounced on its prey at an opportune moment.

Over lunch in New York in early June, Murdoch’s top lieutenant, Chase Carey, told Time Warner Inc. Chief Executive Jeff Bewkes that Fox wanted to buy his company. The two men had gotten together just three days after Time Warner divested its magazine unit, Time Inc., a transaction in the works for more than a year.

The spinoff also made Time Warner much more digestible.

Fox’s offer was also timed when other potential bidders seemed scarce. Several deep-pocketed companies that might have had interest in their own offer for Time Warner were already consumed with huge deals. Comcast Corp. was busy with its plan to buy Time Warner Cable Inc.; telecommunications giant AT&T Inc. had just announced its $49-billion deal to buy DirecTV. Microsoft Corp. had just installed a new boss and was figuring out its corporate purpose.

“You always need the right timing and the right price,” said Bob Wright, former chief executive of NBCUniversal and a veteran of merger wars. “Bewkes might have been offered the right price — but the timing wasn’t right for him.”

David Bank, a media analyst with RBC Capital Markets, agreed. “Right now it feels like an auction of one,” Bank said.

Since Time Warner’s board rejected 21st Century Fox’s unsolicited $80-billion cash-and-stock offer, investors have been eager to see how the corporate drama will unfold. Investors appear to be betting on a higher bid: Time Warner stock is up 23% at $87.23 since the Fox approach was disclosed. Meanwhile, Fox stock has largely held its own, and Friday ticked up 24 cents to $33.01.

“Wall Street is waiting for the next salvo,” Bank said. “And we are waiting to see if Time Warner has a Plan B.”

What Time Warner has said publicly is that it plans to continue to operate as an independent company, telling shareholders that it will be more profitable that way. The company also blasted the $85-per-share offer as being too low.

Time Warner also objected to Fox’s plan to use non-voting shares as a component of the deal because that would keep the Murdoch family firmly in control. Time Warner questioned whether Fox — led by the 83-year-old press baron — was capable of managing such an unwieldy and complex organization.

Murdoch has long made it clear that he wants to pass the baton to his two sons, James and Lachlan. Investors previously have expressed concerns that neither Murdoch son is sufficiently tested.

“Rupert is not dumb,” Wright said of Murdoch’s bidding strategy. “He put out a big price because he knows it would be hard for Time Warner to say no. Now Time Warner can’t accept a bid of $60 billion from Google or some other company when Rupert has already offered $80 billion.”

Some investors are wondering whether Fox’s pursuit of Time Warner will be a replay of its 2007 acquisition of Wall Street Journal publisher Dow Jones & Co. Murdoch relentlessly pursued the company, wearing down the previous owners with a price that reached $5.6 billion. In that case, there were no other bidders.

Time Warner, in contrast, is hoping that this year’s drama will be a repeat of Comcast’s failed bid a decade ago for Walt Disney Co. The Burbank company dug in its heels and refused Comcast’s hostile $54-billion offer.

“The situation now for Time Warner is hoping for someone else will come along,” Wright said, adding “someone without all of the entanglements that a merger with Fox would bring.”

Some of those long-speculated names include Internet giants like Google Inc. or Amazon.com Inc. and telecom giant Verizon Communications Inc. Those potential suitors might not have the kind of antitrust concerns that a union with Fox would raise.

If Murdoch is successful with Time Warner, it would create an entertainment giant responsible for a large chunk of the programming on broadcast and cable television.

The combined company would be the biggest provider of prime-time television shows, producing nearly 40% of the broadcast networks’ scripted schedules. Both have a large presence on cable and daytime TV as well.

That size and the potential leverage such an entity could have over writers and producers is likely to be of huge concern to the creative community and lawmakers and regulators tasked with reviewing a deal.

The television industry is already consolidated. Besides Fox and Warner Bros., the other major players are Disney, Sony, CBS, NBCUniversal and Sony. In testimony before the Senate Commerce Committee on the issue of consolidation this week, television producer Shawn Ryan said although the number of ways people can get content has exploded, the companies producing it have dramatically shrunk.

“At odds with this proliferation of outlets is a disturbing truth about American media,” said Ryan, who represented the Writer’s Guild of America, West. “It is controlled by only a handful of companies, formed through two decades of vertical and horizontal integration,”

Although there are currently no rules about how much content one company can produce and distribute, the Federal Communications Commission previously did regulate program production with regard to broadcast networks.

The FCC has shown little desire in recent years to step back into regulating the production of content. However, the potential clout of a 21st Century Fox-Time Warner combination probably would lead to calls from Hollywood unions, media watchdogs and consumer activists for restrictions.

“This is the kind of stuff that congressional people and the FCC love to use as fodder for hearings,” Wright said.

Not only would a 21st Century Fox-Time Warner churn out a lot of the programming, it would also control a lot of the buyers too. Fox owns entertainment cable channels FX and FXX; Time Warner’s holdings include HBO, TNT, TBS and Cartoon Network.

At first glance, there is nothing in a 21st Century Fox-Time Warner marriage that would run afoul of FCC regulations. However, that doesn’t mean the FCC may not have the ability to weigh in on the deal should it happen and attempt to impose conditions.

One way for the FCC to do that involves a long-forgotten Time Warner property — WPCH-TV in Atlanta.

Should 21st Century Fox succeed in its effort to acquire Time Warner, the FCC would presumably have to sign off on the license transfer of the station, even if 21st Century Fox ultimately decided to sell it. WPCH-TV is an independent station that was previously WTBS-TV, the first big media property of Ted Turner when he started building his empire. When WTBS went to cable and became TBS, the call signs of WTBS were changed to WPCH.

The station is operated by Meredith Corp. but the license belongs to Time Warner.

That the FCC could involve itself in such a merger is not to be taken lightly. Whereas a 21st Century Fox-Time Warner deal would certainly get scrutiny from the Justice Department for anti-competitive reasons, the FCC can also try to dictate how the combined entity operates.

Murdoch has never been a fan of the FCC and has tangled with the agency numerous times over the years. As recently as this week, Murdoch criticized the FCC on Twitter, calling its regulations that prohibit him from buying the Los Angeles Times “from another age.”

He was referring to the FCC’s newspaper-TV cross-ownership rule, which prohibits one company from owning a newspaper and TV station in the same market. Tribune Co. has a waiver from the FCC to operate both KTLA-TV Channel 5 and The Times.

More to Read

From the Oscars to the Emmys.

Get the Envelope newsletter for exclusive awards season coverage, behind-the-scenes stories from the Envelope podcast and columnist Glenn Whipp’s must-read analysis.

You may occasionally receive promotional content from the Los Angeles Times.