Herbalife CEO boosts his stake in struggling company

The chief executive of Los Angeles nutritional products maker Herbalife Ltd. is adding more than $12 million of company stock to his personal holdings, a move the firm said shows his “complete confidence in the continued and future success of the company.”

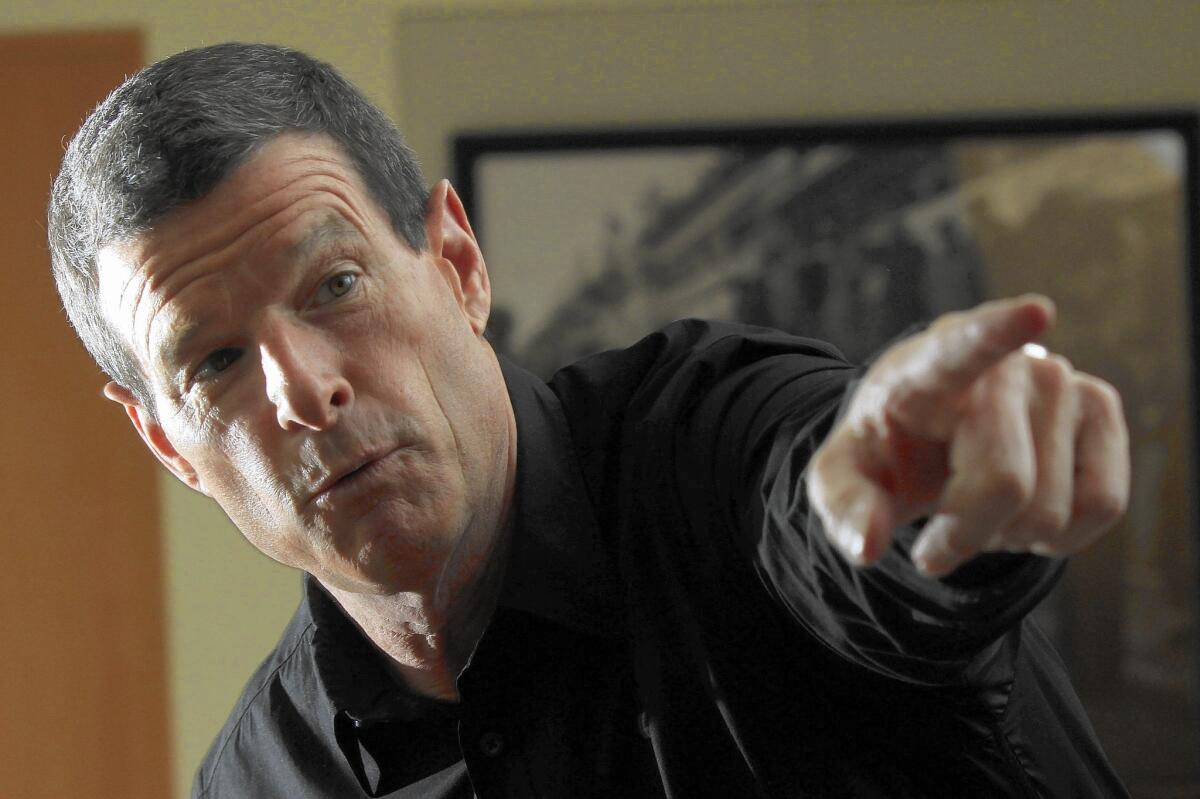

Michael O. Johnson, who also is Herbalife’s chairman, decided to add shares in the midst of one of the most difficult years in the company’s history.

The move prompted skepticism from hedge fund manager Bill Ackman’s Pershing Square Capital Management firm, which has been arguing publicly for nearly two years that Herbalife is a pyramid scheme and had bet more than $1 billion at one point that the stock would drop to zero.

“We believe the only reason Mr. Johnson is retaining those shares is that he has no choice but to hold them in light of the ongoing multiple federal and state investigations of the company,” Pershing Square said.

Herbalife said that Johnson could have sold the shares, part of stock options he exercised, but elected not to because he believes in the company’s future.

“There was nothing preventing him from selling the shares he received. The fact that he chose not to reflects his complete confidence in the direction of the company,” Herbalife spokesman Julian Cacchioli said.

Johnson now owns about 1.4 million shares of Herbalife stock valued at about $58 million, based on Tuesday’s closing price of $41.99.

A former Disney executive who has guided Herbalife since 2003, Johnson added 292,454 Herbalife shares Tuesday after exercising 750,000 stock options — granted in 2004 — that were due to expire next month. He sold the rest of the shares “to cover the exercise price and any taxes related to the transaction,” Herbalife said.

Herbalife, which soared last year in the face of Ackman’s public denunciations of it, has been on the ropes this year.

In March, the Federal Trade Commission said it was investigating claims that the company’s structure operates essentially as a pyramid scheme that victimizes many of its independent salespeople. The investigation is ongoing.

Herbalife also has missed earnings targets in each of the last two quarters, and investors have pummeled the company’s stock, which is down 47% so far this year.

Herbalife’s weight-loss shake mix, vitamins and protein bars are not available in retail stores. They can be purchased only from its members, who profit from sales they make and from sales made by others they recruit into the business.

The 34-year-old company was thrust into the spotlight by Ackman’s claims in December 2012.

Ackman accused Herbalife of operating as a complex pyramid scheme that victimizes a network of predominantly minority distributors who were attracted by promises of wealth but ended up making little or no money selling its products.

At the time, he said he had shorted the company’s stock by more than $1 billion, a move that would allow him to profit if its stock price fell. He also predicted that regulators would shut down the company.

Herbalife has denied the allegations, saying many of its distributors join the company to receive discounts on products they intend to consume personally, not to make a living.

It’s a business model employed for decades by many other multilevel marketing companies, Herbalife said.

Twitter: @spfeifer22