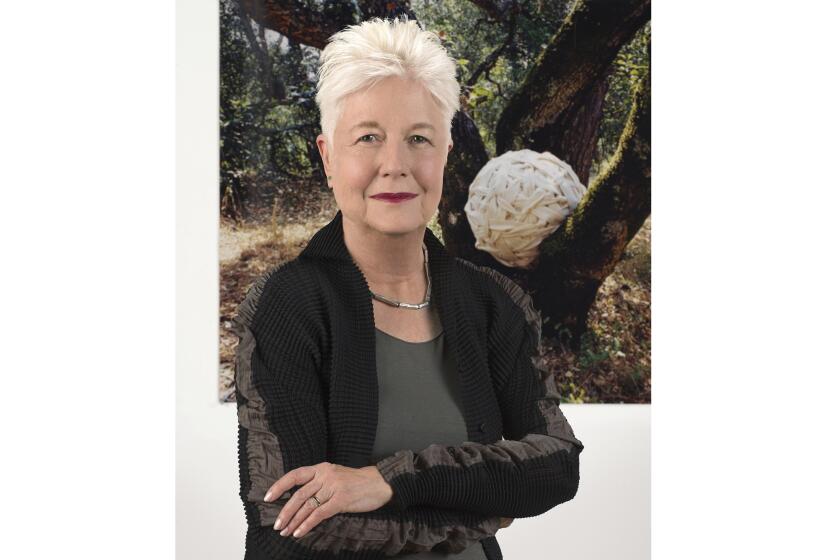

Nancy Teeters dies at 84; first woman on Federal Reserve board

Nancy Teeters, who in 1978 became the first woman on the Federal Reserve board of governors, then continued to stand out by opposing Fed Chairman Paul Volcker’s anti-inflation campaign, has died. She was 84.

Teeters died Nov. 17 at an assisted living facility in Stamford, Conn., the Washington Post reported, citing her daughter, Ann Teeters Johnson. The cause was complications from strokes.

As a Fed governor from 1978 to 1984, Teeters was a lonely dissenting voice when, in her view, the war on inflation led by Volcker went too far.

She protested as large banks raised their prime rates to 21.5% in December 1980 and warned that high interest rates would cause the U.S. economy to contract. “You don’t need to go to 20 or 21% to restrain the monetary supply,” Teeters told the New York Times in January 1981.

Because Fed dissents aren’t disclosed to the public until minutes are released, often weeks after a meeting, the effect of Teeters’ opposition was limited. Even inside the Fed, her “no” votes became “discounted during the long recession because she was regarded as a knee-jerk liberal,’” William Greider wrote in his 1989 book on the central bank, “Secrets of the Temple.”

Teeters worked as chief staff economist of the House Budget Committee before President Carter appointed her to the Fed. She was “well known and respected as a liberal economist, a disciple of John Maynard Keynes and the Keynesian principles that had guided the Democratic Party’s economic policy” since the presidency of Franklin D. Roosevelt, Greider wrote.

As “a dove among the Fed’s hawks,” as a New York Times headline called her in 1978, Teeters urged a “pause” in higher interest rates soon after being sworn in on Sept. 18, 1978. In one of her first acts, she voted against a move by the chairman, G. William Miller, to raise the discount rate 25 basis points to 8%.

Since all Fed governors depend on the same senior staff for data and advice, “it took a strong-willed governor to stand alone and repeatedly argue for a competing analysis,” Greider wrote. “Nancy Teeters was one.”

Her dissents became less frequent after 1982, and in 1984, toward the end of her term, she told the New York Times she had supported the thrust of the Fed’s anti-inflation campaign.

Teeters was often the sole objector as well on votes to approve bank acquisitions, citing interstate banking laws that were still on the books and often ignored. “I don’t want to see the U.S. banking community become just 10 large banks,” she told the trade newspaper American Banker in 1984.

In July 1984, weeks after leaving the Fed, Teeters became director of economics at IBM. She was elected an IBM vice president and chief economist in March 1986 and retired in 1990, when she was 60.

She was succeeded on the Fed board by its second-ever female governor, Martha Seger, a finance professor at Central Michigan University appointed by President Reagan.

She was born Nancy Hays on July 29, 1930, in Marion, Ind., the daughter of S. Edgar Hays and the former Mabel Drake. She earned a bachelor’s degree in economics from Oberlin College in 1952 and a master’s in economics from the University of Michigan in 1954.

She met her husband, Robert D. Teeters, at Oberlin, and together they moved in 1957 to Washington, where she worked as a staff economist for the Fed board’s government finance section. Her job included estimating federal receipts, expenditures and ownership of the national debt.

From 1958 to 1964 she had three children — Ann, James and John. To keep her job at the Fed while pregnant, she had to use sick days, vacation days and flexible hours to fashion maternity leaves, she told the New York Times in 1993.

After spending a year on the President’s Council of Economic Advisors under John F. Kennedy, Teeters returned to the Fed in 1963. In 1966 she became a fiscal economist with the Bureau of the Budget — forerunner to today’s Office of Management and Budget — and joined the Brookings Institute in 1970. With Charles L. Schultze, Edward R. Fried and Alice M. Rivlin, she coauthored the 1971, 1972 and 1973 editions of the budget analysis, “Setting National Priorities.”

In 1973 she became senior specialist on the federal budget for the Congressional Research Service. She joined the House Budget Committee as chief economist in December 1974, as the newly created panel was being constituted. Carter nominated her as a Fed governor in August 1978, to fill out the term of Arthur Burns, who had resigned as Fed chairman. She would serve until June 27, 1984.

The board put her in charge of an effort to control credit extended by banks and retailers as a means to fight inflation. When business leaders descended on the Fed to try to figure out what the policy meant for them, Teeters “struggled with their questions and wound up saying that life is both confused and unfair,” New York Times business columnist Leonard Silk wrote.

“The perception was that we told people to stop using the credit cards,” Teeters told the Washington Post in 1984, as her tenure was reaching an end. “In fact, what we did was to tell the credit card issuers to not let the thing grow so fast.” Many Americans, confused by the message, went so far as to return their cards to retailers, Teeters said.

Asked her thoughts on her Fed experience, she said: “It’s been fascinating and engrossing, but I guess I’m not going to miss it very much.”

Her husband, an ecologist, died in 2008. Survivors include their three children, six grandchildren and a brother.

Arnold writes for Bloomberg News.

More to Read

Start your day right

Sign up for Essential California for the L.A. Times biggest news, features and recommendations in your inbox six days a week.

You may occasionally receive promotional content from the Los Angeles Times.