Mattel CEO resigns as sales falter

Mattel Inc.’s ground-losing tussle in the toy aisle has claimed a victim.

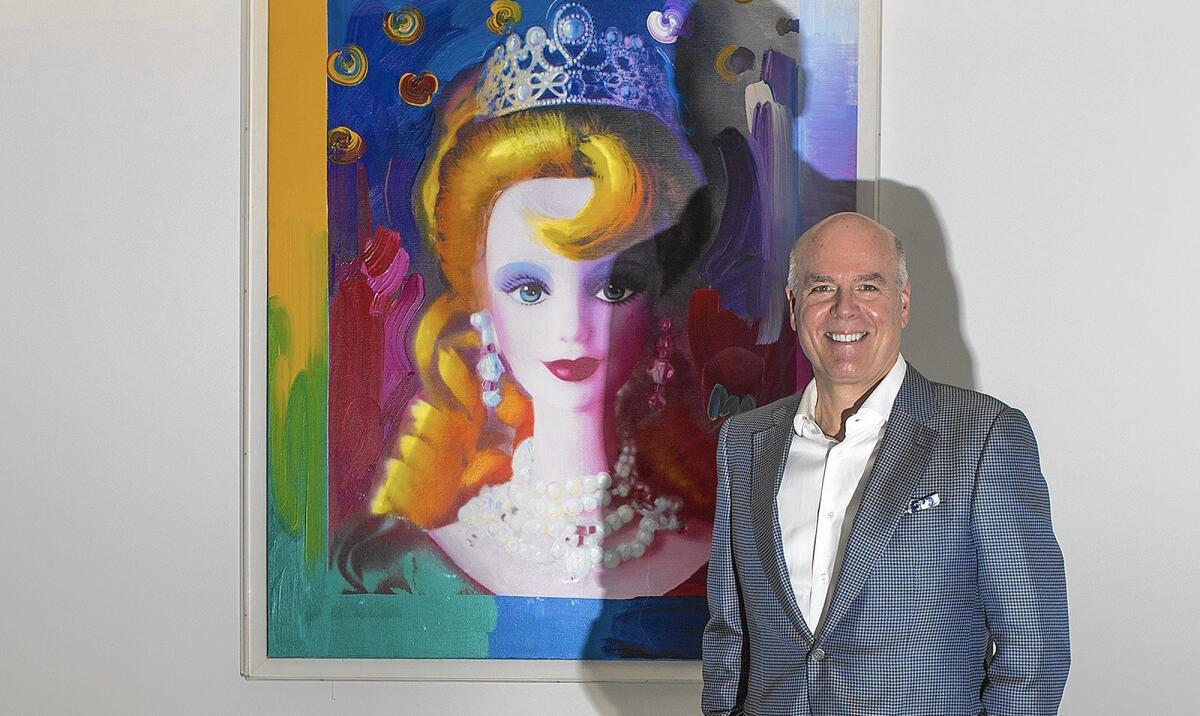

Bryan G. Stockton, the El Segundo company’s chairman and chief executive, resigned after failing to turn around the toy maker.

Mattel had been hustling to revamp the business as classics Barbie and Fisher-Price were losing favor with young customers.

But its efforts have been unsuccessful. In the last three months of last year, which includes the crucial holiday-shopping season, sales slid 6% to $2 billion, according to preliminary estimates released Monday.

Mattel’s troubles come at a time when the toy industry is scrambling to evolve with changing consumer tastes. Parents are cutting back on buying traditional playthings as children ask for smartphones and tablet computers instead.

“Companies like Mattel, LeapFrog and Hasbro are facing challenges from technology,” said Jason Moser, an analyst at the Motley Fool. “Physical toys are just maintaining a much shorter life span than ever before.”

But Mattel’s problems went deeper. Going into the holiday season, the toy maker offered few innovative products. Even American Girl, which has been a bright spot, reported a sales drop in the third quarter. In September, Mattel lost its long-held mantle as the world’s biggest toy company to Danish rival Lego.

Mattel’s innovation problem can partly be blamed on a bureaucratic culture that unwittingly stifled creativity — the lifeblood of toy firms. The 61-year-old Stockton, who earned $15.5 million in 2013, has been described as smart and affable but lacking a leader’s charisma.

“They got slow,” said Gerrick Johnson, an analyst at BMO Capital Markets, “when the toy business has gotten quicker and quicker.”

Mattel bought Mega Brands Inc. in April, which is known for arts and construction toys, two toy categories that are growing.

Mega Brands employees who stayed on with Mattel complained that “things that at Mega Brands take two hours to do take two days at Mattel, and things that take two days at Mega Brands take two weeks at Mattel,” Johnson said.

Stockton acknowledged in an interview in November that the company needed a strategic revamp, but he said he was optimistic about the holiday season after a poor showing during the 2013 holidays.

“This is a challenging business,” he said. “It changes so much, and because of rapid change you can have a season that’s not what you would like. What we want to do is try to make sure we don’t go through that again.”

Mattel excelled for years at churning out new brands and fresh spins on its mainstays. Its leggy Barbie doll enjoyed a surge in popularity around 2010; that same year, a new fashion doll franchise called Monster High debuted with success.

“Monster High came out of nowhere and did very good business,” said Sean McGowan, managing director of equity research at Needham & Co. But in recent years, “several very important product categories have been weak.”

With the industry changing so swiftly, toy makers increasingly are piggybacking off popular movies and TV shows. Sales from merchandise related to Disney’s princess brands, especially the hit movie “Frozen,” raked in more than $300 million a year for Mattel, analysts said.

But Mattel was dealt a blow in September when it lost the doll licenses to Disney’s “Frozen” and Princess properties to rival Hasbro starting next year.

“When Mattel lost out on Disney Frozen to Hasbro, that was significant,” Moser said. “That deal is worth hundreds of millions of dollars that Mattel isn’t going to see.”

Mattel’s preliminary estimates of lower-than-expected sales and earnings pushed its stock down $1.40, or 5%, to $26.64 a share Monday, a price little changed from when Stockton took over as CEO in January 2012. It would be the fifth straight quarter that sales fell for Mattel, which employs about 29,000 people worldwide, including about 2,000 in El Segundo.

Mattel board member Christopher A. Sinclair, 64, a former longtime PepsiCo executive, was tapped as chairman and interim CEO until a permanent replacement for Stockton can be found.

Mattel may choose to look outside the company for a successor, analysts said. Stockton joined Mattel in 2000 as executive vice president of business planning and development, and took over as CEO after longtime chief executive Robert Eckert stepped down.

“The risk of bringing someone in from the inside is they have been exposed to that culture so long they don’t know how to change it,” said Moser, who pointed to Ford’s success under former CEO Alan Mulally, who was brought in from aerospace giant Boeing.

Leading contenders within Mattel are Tim Kilpin and Richard Dickson, both of whom were named president this month. Kilpin directs sales and marketing globally. Mattel alumnus Dickson was brought back last year after previously overseeing Barbie’s last turnaround.

With the right leader, the same quick-paced environment that has pummeled Mattel could help it thrive again, observers said. Mattel could tap outside inventors for creative ideas and use its muscle to bring toys quickly to market.

“There are lots of opportunities for these guys to improve,” Johnson said.

Twitter: @ByShanLi