Complicated foreign excise tax for U.S. companies could pose problems for House Republican tax bill

As a House committee on Monday pushed toward a vote on the Republican tax legislation, conservative groups aligned with the wealthy Koch brothers raised concerns about a complicated excise tax proposed for foreign transactions of multinational companies.

Freedom Partners, which is funded by the Koch brothers and its network of donors, compared the proposed excise tax to a controversial border-adjustment tax that they helped kill this summer as congressional Republicans and the Trump administration were crafting the legislation.

“This new 20% tax would apply to cost of goods sold, which could ultimately saddle consumers with higher costs, undermining the economic benefits of the larger bill,” Nathan Nascimento, Freedom Partners vice president of policy, wrote in a letter Monday to committee members.

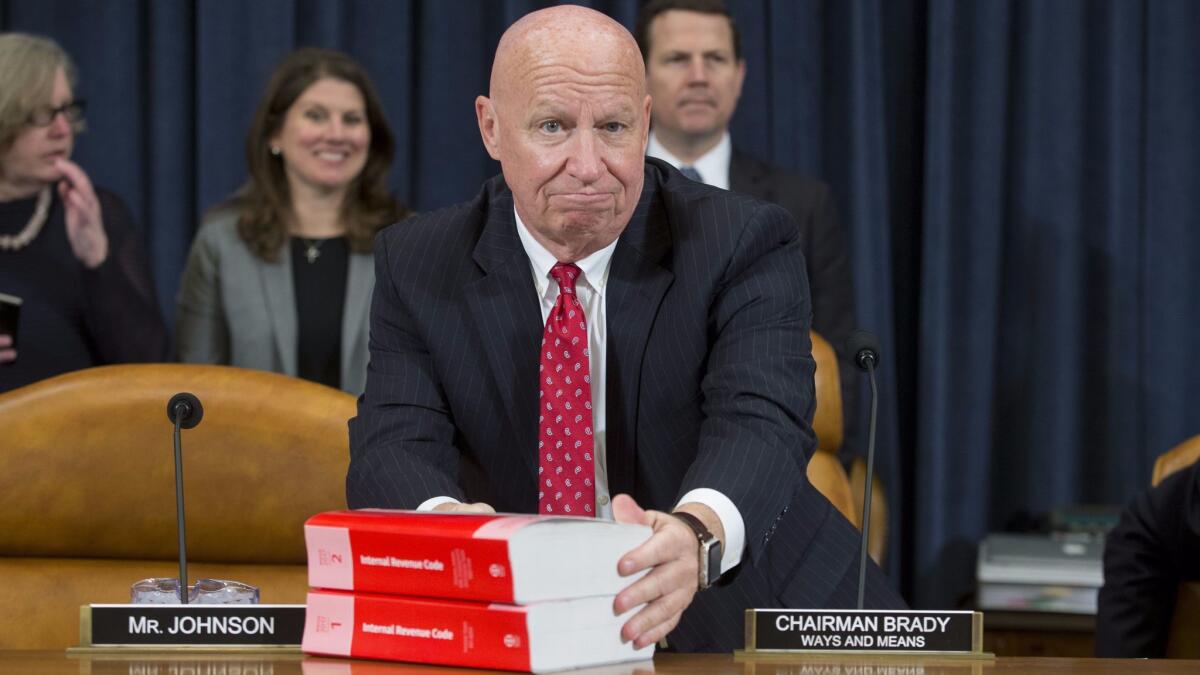

Members of the House Ways and Means Committee began several days of debating the bill and considering amendments. The bill centers on a large cut to the corporate tax rate and a simplification of the individual tax code that reduces rates but also scraps or scales back some popular deductions, such as those for mortgage interest and state and local income taxes.

Looming ahead is an even tougher battle in the Senate, where Republicans have a razor-thin majority and several GOP senators have raised objections to adding $1.5 trillion to the deficit. Senate Republicans plan to roll out their bill Thursday.

Lawmakers in both the House and Senate are hearing objections from many outside groups — including evangelicals hoping to preserve an adoption tax credit and local governments fighting to keep the tax exemption for certain municipal bonds.

“Our committee has dedicated a substantial amount of time, energy and work to the pursuit of one landmark goal — delivering comprehensive tax reform to the American people,” said the panel’s chairman, Rep. Kevin Brady (R-Texas), a key drafter of the legislation.

But Democrats accused Republicans of rushing the legislation to a vote without having experts testify on the bill’s effects.

“I believe this tax plan is blatant fraud being perpetrated against middle America,” said Rep. Brian Higgins (D-N.Y.).

Brady said the excise tax being targeted by the Koch groups is “nothing like” the border tax.

The excise tax is needed to stop multinational companies from using transactions with foreign affiliates to reduce their U.S. taxes, said Brady, who has stressed that lawmakers would continue to work on the excise tax proposal as the bill moves through Congress.

But significant changes to the provision could be difficult to achieve because it is estimated to produce $155 billion in additional revenue over the next decade, a major offset.

The excise tax was a surprising addition to the 429-page Tax Cuts and Jobs Act unveiled by House Republican leaders last week.

The excise tax is a new approach to preventing companies from using foreign affiliates to lower their U.S. taxes.

Companies can sell a good or service to a foreign affiliate at an inflated price, then deduct the cost on their U.S. taxes. The maneuver has the effect of shifting profits overseas, where they often are taxed at a lower rate.

“If the U.S. company takes a large deduction for a good or service that’s overpriced, including the use of a license or a patent, that profit is taken out of the U.S. tax base and shifted to a country like Ireland with a lower tax rate,” said Steve Rosenthal, a senior fellow at the Tax Policy Center, a nonpartisan think tank.

The Ways and Means Committee said that “results in a distorted computation of the overall U.S. tax liability of multinational companies.”

To prevent that, companies with at least $100 million in annual payments to foreign affiliates would face a 20% excise tax on such transactions. They could avoid that tax by subjecting the foreign affiliate’s net profits from such transactions to U.S. taxes.

The centerpiece of the bill is a reduction in the overall U.S. corporate tax rate to 20% from 35%.

Edward Kleinbard, a USC professor and former chief of staff to Congress’ Joint Committee on Taxation, said the provision is designed to use the threat of an excise tax to force companies to take the second option.

The result is similar — the U.S. recovers lost tax revenue.

Kleinbard and Rosenthal said the provision is much different from the border-adjustment tax, which was projected to raise as much as $1 trillion in revenue over 10 years.

The tax would have subjected importers to higher taxes than exporters or those that produce products in the U.S. for domestic consumption. Major exporters supported a border tax, but retailers that import a lot of goods, such as Wal-Mart Stores Inc., opposed it.

House Republicans ditched the idea because of strong opposition.

Twitter: @JimPuzzanghera

UPDATES:

3:50 p.m.: The story was updated to remove the Tax Policy Center analysis after the organization said it had made an error in its calculations and would revise its figures.

3:15 p.m.: The story was updated with information about a Tax Policy Center analysis and the House Ways and Means Committee hearing.

The story was originally published at 12:45 p.m.